This article is all about trends in startup business funding. If you want to learn about investing in startups in 2023, then this is your guide!

Startups are becoming an increasingly popular option for entrepreneurs looking to enter the business world. However, securing funding in order to maintain operations and sustain growth is often a challenge.

The end of 2022 saw a concerning trend formulating whereby stats suggest that investors might be becoming more conservative in where they park their funds. It also appears that huge valuations may be a thing of the past. Unicorns (startups valued at over $1bn) may be becoming extinct.

This article will discuss the impact of valuation on startups, factors contributing to rising investor conservatism, and challenges faced by early-stage startups in securing startup business funding.

How are the trends for investing in startups changing? We will discuss ways for startups to adapt their strategies and survive in an increasingly difficult environment.

Over the past few years, there has been a significant increase in the amount of https://gaper.io/hire-python-developers-fintech-startup/startup business funding globally. In 2021, the global startup ecosystem received $304.5 billion in funding, a 10% increase compared to the previous year.

The funding market remained very heated, and according to some opinions, overbought, throughout 2022. However, reports released at the end of 2022 painted a different picture for the future.

It appears that investors, VCs, and other financial players are beginning to get more and more cautious about investing.

The United States remains the leading country for startup funding, accounting for over half of the total investment globally. In 2021, U.S.-based startups received $166 billion in funding, a 25% increase compared to the previous year. China and India follow the U.S., with $56 billion and $17.6 billion respectively.

“Founders need to understand the different stages of funding in order to plan better and know how to approach investors accordingly. “Failing to plan is planning to fail”, this is why an effective fundraising strategy is crucial for startups.”

If you’re a startup founder or entrepreneur, these trends may impact your startup in several ways. Firstly, it’s likely that you’ll need to raise more capital to stay competitive. Larger funding rounds typically require more dilution of your equity, and you need to be prepared for this if you plan on raising a large round.

You’ll worry about achieving some level of success before you can attract the attention of investors. This means you need to establish some traction and demonstrate that your business has the potential for growth.

Another factor to consider is the increasing popularity of sustainability-focused startups. If you’re in a sector that has the potential for creating a positive social or environmental impact, you may find it easier to attract investors.

However, this doesn’t mean that other sectors are not receiving startup business funding. It simply means that you may need to tailor your pitch to highlight how your business is making a positive impact.

Lastly, the trend in larger funding rounds means that there is a higher probability of your startup getting lost in the sea of other startups. To stand out, you need to have a solid business plan, a unique value proposition, and a strong team that can execute your vision.

Other factors can also affect how your business stands in the competitive landscape of fundraising.

“AI and ML are continuously evolving and will continue to be a hot topic in the startup world in 2023. Startups that prioritize these technologies are gaining momentum in various industries, including healthcare, finance, and retail.”

Disrupting the Future: Top Startup Trends for 2023

Artificial intelligence and machine learning are transforming the startup ecosystem. They are being used to improve existing business models, identify new growth opportunities, and optimize operational efficiency. The use of AI and machine learning has also led to the creation of new business models, such as those based on data monetization and prediction markets.

ESG (Environmental, Social, and Governance) factors are becoming increasingly important in the startup ecosystem. Investors are now looking for startups that are committed to sustainability, social responsibility, and good governance practices. ESG factors can affect a startup’s funding and valuation, as well as its long-term growth prospects.

As the startup ecosystem continues to evolve, new market segments are emerging. These include niche markets, such as healthtech, edtech, and fintech. Startups operating in these markets are attracting significant funding and valuation, as investors recognize their potential to disrupt traditional industries.

Government policies can have a significant impact on startup funding and valuation. Policies that foster innovation and entrepreneurship can create a favorable environment for startups to thrive. Conversely, policies that are hostile to startups can stifle growth and discourage investment. Understanding the impact of government policies on startup funding and valuation is crucial for startups looking to succeed in the long term.

The success of a startup is closely related to its valuation. Valuation is the process of determining the worth of a startup, usually based on its potential for growth and the amount of funding it has received. Once again, the trend in startup valuation has continued to show growth over the years.

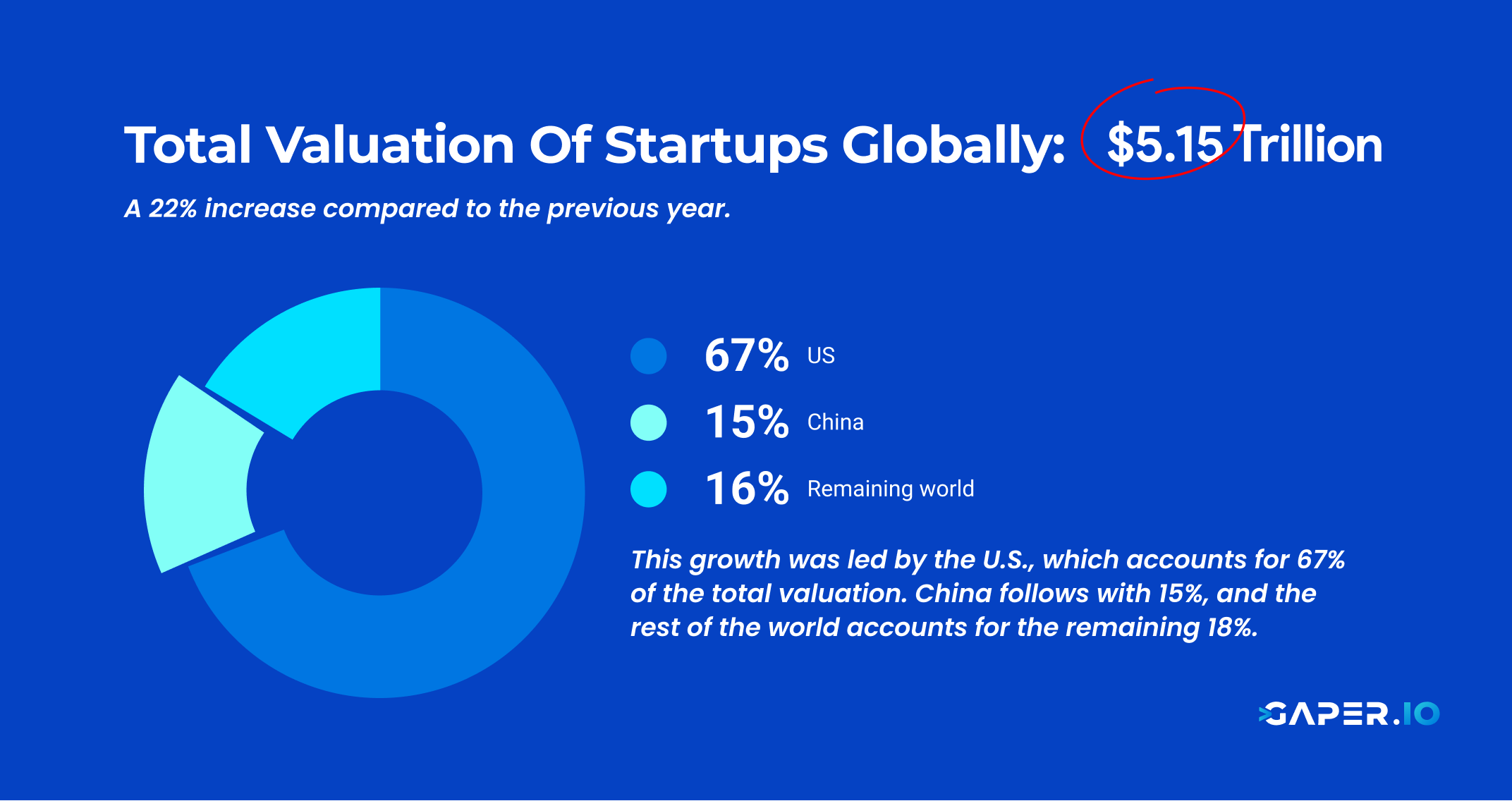

In 2021, the total valuation of startups globally was $5.15 trillion, a 22% increase compared to the previous year. This growth was led by the U.S., which accounts for 67% of the total valuation. China follows with 15%, and the rest of the world accounts for the remaining 18%.

The trend in larger funding rounds also means that startups are reaching unicorn status faster than ever before. In 2021, there were 136 new unicorns globally, bringing the total number of unicorns to 861. This means that more startups are being valued.

What is the scene of investing in startups in 2023? The impact of valuation on startups is becoming increasingly apparent. As investors become more conservative in their approach to selecting companies for funding, valuations will play an important role in determining whether or not a startup receives any external investment.

Startups with higher valuations are more likely to be attractive to potential investors and thus have better chances of securing the funding they need. Meanwhile, startups with lower valuations may find it more difficult to access capital and will be forced to look for alternative financing sources.

Additionally, higher valuation companies may receive better terms from investors, such as longer-term investments or larger amounts of capital. As a result, understanding and managing startup valuation is critical for all businesses looking to secure the necessary funding.

2023 is seeing a shift in investor sentiment, with many investors becoming more conservative in their approach to startups. This trend can be attributed to several factors, including the state of the economy, geopolitical tensions, and global upheavals caused by the pandemic.

Additionally, with increasing competition in markets and sectors, investors are wary of taking risks and are more likely to be cautious when investing in startups. This is particularly true for early-stage companies, as investors will often demand a higher valuation before investing in them.

As a result, startups may need to adjust their strategies to ensure that they look attractive to potential investors.

The decline in the number of startups raising $1bn or more in both 2022 and 2023 is a concerning trend that reveals the difficulty many companies face when trying to secure large amounts of capital.

In 2021, the number of unicorn founders—startups with valuations exceeding $1bn—dropped by around 3%, compared to 2020. This trend has continued in 2022 and 2023, with the number of startups raising $1bn continuing to decrease.

This indicates that investors are becoming increasingly cautious when it comes to investing large sums, preferring to focus on safer investments with lower risks.

Early-stage startups continue to face challenges when it comes to raising funding in 2022 and 2023. Despite experiencing a surge in venture capital investment in 2021, many early-stage companies still struggle to secure the necessary funds.

This is due to investors’ reluctance to invest in startups with lower valuations, as well as their unwillingness to take risks.

As a consequence of this, many startups must consider alternative financing options, such as crowdfunding campaigns or angel investors. Additionally, companies may need to adjust their strategies and focus on building out more tangible products or services that can attract potential investors.

One example of an early-stage startup facing this challenge is an artificial intelligence company based in New York City. Despite having a promising product, the company has struggled to secure larger amounts of funding due to its lower valuation and lack of tangible output. As a result, the startup has been forced to focus on building out more concrete products and services in order to attract potential investors.

Another example is an e-commerce platform based in California that had been seeking funding for an expansion. Despite having a solid track record and experience in the industry, the company was unable to secure large amounts of investment due to its lower valuation. As a result, the platform has been forced to seek alternative financing sources such as angel investors in order to fund their expansion.

Ultimately, these examples demonstrate the challenges that early-stage startups face when raising funding in 2022 and 2023, indicating a need for companies to adjust their strategies in order to remain competitive.

“Inflation may be showing signs of easing but high-interest rates, energy shortages, and residual pandemic supply-chain issues are likely to slow global growth.”

“Companies will need to make tradeoffs as they face these and other challenges, including climate change and China’s shifting COVID policies.”

The Trends And Challenges Shaping 2023

The changing investment climate in 2023 is likely to have a significant impact on the growth of startups. As investors become increasingly risk-averse, the amount of money available for early-stage startups will likely decrease.

This could mean that smaller companies struggle to secure larger amounts of funding and may need to turn to alternative sources such as angel investors or crowdfunding campaigns. Additionally, larger companies will likely face tougher competition when it comes to attracting investors.

Startups may need to shift their strategies and focus on developing more tangible products or services in order to remain competitive.

Moreover, the decline in the number of unicorns and startup valuations could lead to sluggish growth for many startups in 2023.

With investors preferring safer investments, companies will likely need to adjust their strategies and focus more on developing tangible products or services that can attract potential investors.

Additionally, companies may be forced to reduce costs in order to remain competitive and continue growing.

Ultimately, the changing investment climate in 2023 is likely to have a significant impact on the growth of startups.

Companies will need to adjust their strategies in order to remain competitive and continue growing, or risk being left behind by larger companies that can attract investors with more tangible products or services.

Startup businesses should focus on building out more concrete products and services that can help them secure funding.

As the investment climate continues to change in 2023, startups may need to adapt their strategies in order to remain competitive and secure funding. Here are three different ways that startups can adjust their approaches and survive in an increasingly conservative environment:

Highlight your commitment to customer satisfaction, and demonstrate how your startup’s products or services address specific customer pain points.

By following these strategies, organizations can adjust their strategies to raise better startup business funding in 2023. By developing tangible products or services that have a clear market application, leveraging alternative financing sources, and cutting costs, companies can stand out among the competition and secure funding to fuel their growth.

It is therefore essential for startups to be proactive in adapting their approaches and strategies if they are to survive in an increasingly conservative investment environment.

Overall, it is clear that the global investment landscape is becoming more and more conservative and it is up to startups to find ways to stay afloat in this environment.

Valuation has a big impact on investing in startups, so understanding the factors that contribute to investor conservatism is important for any business looking for external funding.

By educating themselves about the shifting investment climate and adapting their strategies accordingly, startups can increase their chances of raising a fair round of startup business funding!

What are the startup market trends in 2023?

Here are some interesting and insightful pointers on the startup market trends in 2023:

Increased focus on healthcare: With advances in AI and machine learning, healthcare startups are likely to play a more significant role in the market. There will be an increase in companies creating innovative technologies to improve patient care.

Continued growth of fintech: Fintech startups have been growing at an incredible pace in recent years! Startups are likely to continue applying technological advancements to finance and banking, such as blockchain and AI.

The continued rise of E-commerce: The pandemic has accelerated the trend toward e-commerce, which is unlikely to slow down in 2023. This year will be all about personalized shopping experiences and sustainable practices within this sector.

Sustainability and Environmentalism: With the world shifting towards sustainability, startups that prioritize eco-friendly practices will likely gain more traction. Investors will be more conscious of environmental impact and startups leveraging technologies to achieve sustainability.

Workplace flexibility: The trend of remote work and workplace flexibility is here to stay! Startups may continue to create new technologies to facilitate remote work

Greater Accentuation In AI: Artificial intelligence will continue to be a useful tool for startups, pushing the needle towards efficient applications in business and society.

How do you analyze a startup valuation?

Here are some pointers on how to analyze a startup valuation:

Assess the market opportunity: Look at the startup’s target market and size of the market in which they operate.

Evaluate the team: A startup’s valuation depends on the team behind the idea.

Track record: Investigate the startup’s history, milestones, traction, and progress towards achieving their goals.

Financials: Study the startup’s revenue, expenses, cash flow, and burn rate to judge its sustainability and financial state.

Competition: Examine the competitive landscape and look at the startup’s unique aspects of its product in comparison to others in the industry.

Funding: Analyze the funding history of the startup, its funding sources, and how much has been raised previously.

Potential risks: Identify any potential risks associated with the startup’s technology, market conditions or other variables that may impact future growth.

What is the funding valuation of the startup?

Funding valuation is a crucial aspect of the startup world, representing the estimated worth of a startup before its funding round. It’s like a startup’s elevator pitch, wherein the startup presents itself to the investor while emphasizing its potential growth.

The total valuation of a company plays an integral role in any funding round, allowing investors to make informed choices on how much equity they’d like to obtain in the company. It’s a complex process that uses various factors to arrive at a fair market price for a company.

The funding valuation in a startup is more than just a number. It represents the potential of an idea, the strength of the team behind that idea, and the market’s ability to support it. An accurate funding valuation translates not only into equity but into the allocation of resources and the means to succeed.

Ultimately, successful startup funding requires accurate startup valuation! It should capture the essence of the company’s potential and drive necessary resource allocation to achieve growth targets. Thus, funding valuation is the first step in a long journey toward making a startup’s vision a reality.

What is the Series A valuation for 2023?

Series A valuation for 2023 will depend on several factors, including market trends, economic conditions, and the success of individual startups. It’s important to note that valuations can vary widely between industries and individual companies.

Some factors that can influence Series A valuation include overall market size, growth potential, team experience, and traction. Ultimately, each startup will need to assess its own valuation based on its unique circumstances and market conditions at the time of the funding round.

What’s one prediction you have for the business in 2023?

One prediction for business in 2023 is that technology and automation will continue to transform the workplace. There will be an increased emphasis on upskilling and reskilling employees. As more jobs become automated, businesses will need to invest in reskilling their current workforce!

This investment in employee training and development can lead to a more loyal and engaged workforce. Additionally, the growing concern for sustainability may become a mainstream priority for many businesses. Businesses will be able to adopt eco-friendly technologies and practices to build a greener future.

Top quality ensured or we work for free