There is a lot of work involved in starting a new company. A startup must go through a series of barriers, including refining an idea, finding a team, and creating a proof of concept. When faced with these challenges, startups look for outside capital to help tackle them head-on.

There is a lot of work involved in starting a new company.

A startup must go through a series of barriers, including refining an idea, finding a team, and creating a proof of concept. When faced with these challenges, startups look for outside capital to help tackle them head-on.

One of the first challenges that a new business faces is raising capital. It is a process that can be accomplished in a variety of ways. In order to raise capital, various methodologies can be employed. For startups, the best financing choice is determined by their individual financial needs. Each strategy has its perks and drawbacks.

Raising capital is the most crucial and time-consuming task for a CEO. It requires practice and elegance to deliver a captivating and organic pitch. Pitching can put entrepreneurs in a vulnerable position, but after all, what can be more personal than your passion? Based on professional advice, we’ve broken down the basics. Here’s a step-by-step guide to identifying, cultivating, and building essential business partnerships for your startup.

A company’s growth can be accelerated by fundraising, yet, knowing when to begin the process can be difficult. Why? Because fundraising does not consist of simply pitching your idea and expecting to be rewarded with financial support. It’s a decision you’ll want to consider carefully.

When you accept money from investors, you give them a stake in your business. As a result, your personal equity is diluted, and it opens the door to outside feedback and opinions. Investors aren’t just sponsors; they wield significant power over your company’s strategy, including how you enter new markets, who you hire, and how you develop new products.

When you approach fundraising with clarity and a plan in mind, you’ll have a better chance of succeeding. In the following sections, we’ll go over the numerous factors to consider, but first, let’s go through how fundraising works.

If you’re looking to expand your business in the near future, you’ll likely require additional funds. It could be as basic as increasing production or as grand as buying another company. Simply increasing your cash flow could also be the primary reason for it. Whatever your objectives, several funding options are available, each with its own set of advantages and disadvantages.

You must have a compelling business proposal prepared regardless of the type of financing you seek. The more confident you are in your business’s potential, the more likely you will secure funds.

Entrepreneurs have a wide range of alternatives when it comes to raising capital for a new project. This is beneficial in many ways. To make matters more complicated, there are various ways to fund a project, each with its pros and cons.

The best funding option for you and your start-up will rely on a variety of factors such as

Making the wrong decision can doom your business effort before it has ever had a chance to take flight. With an understanding of how a business can raise money, a founder can decide which strategy is most suited for their company.

Crowdfunding, venture capital firms, angel investors, bootstrapping, and networking are all ways to raise money. That’s why it’s important to distinguish between the various strategies and their varied elements with absolute clarity. It all begins with a thorough understanding of how each route differs.

Whether you’re an entrepreneur who has just started or an experienced business owner, knowing how to raise funds can be the difference between success and failure.

Debt financing and equity financing are two main ways to raise capital

Entrepreneurs and angel investors are more likely to rely on equity financing than are grassroots initiatives such as crowd-funders, bootstrappers, and networking groups.

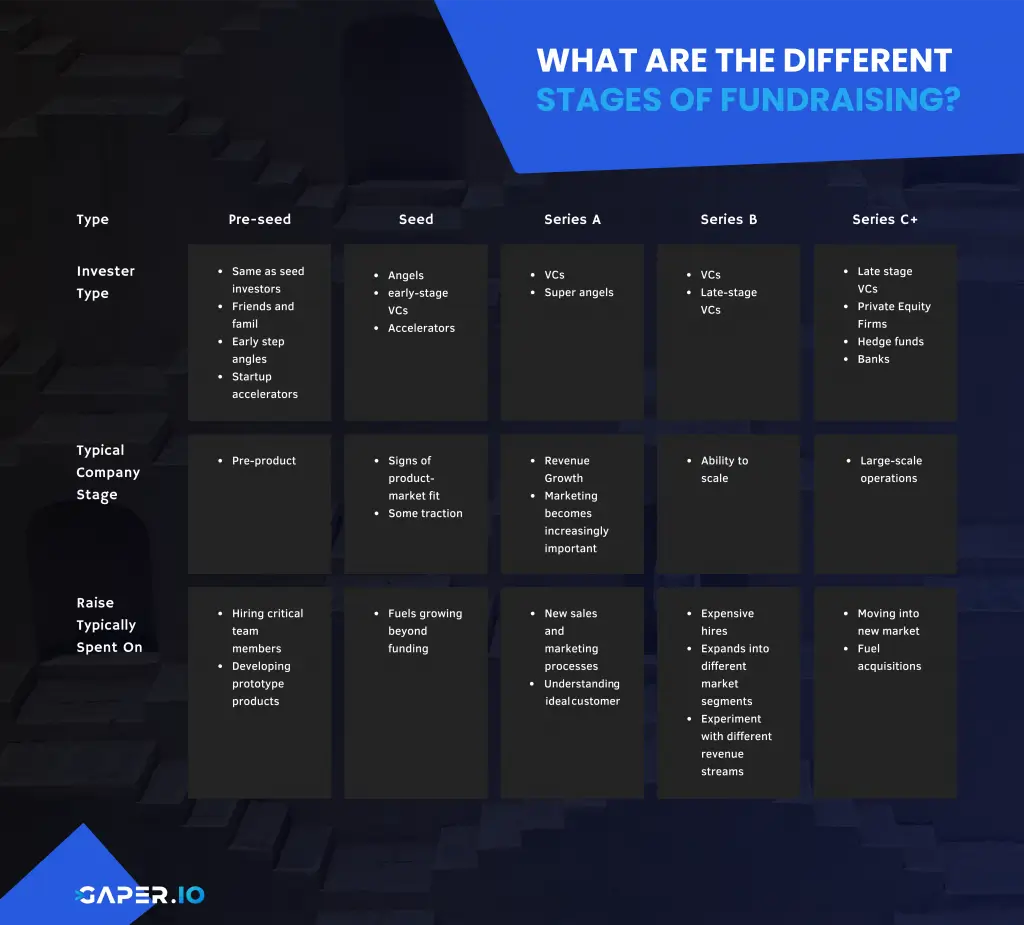

Collecting funds takes time and effort. There are several rounds of fundraising, each with a different purpose and set of requirements.

Let’s go over them one by one to understand the procedure better.

This stage typically refers to the period in which a company’s founders are first getting their operations off the ground.

Your company is just getting started during the pre-seed round. You probably have a great idea, but you don’t yet have a product, customers, or staff. Institutional investors like venture capital firms are usually reluctant to get involved at this point, so many founders use their own money to get operations off the ground and construct a prototype.

The first level of equity investment is known as the seed round. It’s often the initial money that a company or organization raises as an official entity.

A company’s initial round of funding, if not the first, is often the seed round. Hopefully, by this time, you have something you can demo. However, you may still need to develop a minimal viable product (MVP) and undergo beta testing before you’re ready to launch a commercial version of your product. Angel investors and venture capital firms that specialize in seed investment are among the investors who may be interested in your startup’s early stages.

Series A funding is opted by a company to optimize its user base and its products further. This approach is usually used after a company has built up a track record, consisting of a firmly established user base, consistent revenue, or any other KPIs.

During the Series A round, you’ll focus on getting your product to market, proving product-market fit, attracting customers, and generating revenue. Due to their familiarity with KPIs like revenue growth, client acquisition costs, and customer lifetime value, institutional investors are more likely to invest during this round. Most investors in the Series A round prefer immediate ownership equity rather than lending their funds in exchange for convertible debt. You will have to negotiate a formal valuation of your company, which establishes the fair market value of your company’s stock to determine how much equity they’ll receive. Together with the assistance of your attorney, you’ll also need to draft term sheets that detail the conditions of your investment agreement with each investor.

You can expect to raise anywhere from $1 million to $10 million as a founder in the Series A round.

Series B funding is all about moving companies forward from the development phase—investors aid startups on their journey to success by expanding their market reach. After a seed or series A fundraising round, a company has already built up a sizable user base and has shown investors that it is ready to scale up.

The B onward rounds are intended to assist you in broadening your market reach, expanding your company’s internal growth, and becoming profitable. Having a sizable user or customer base, a demonstrated track record of revenue growth, and a proven track record of success are prerequisites for a Series B round. To aid with the growth and expansion of the company, investors typically join in at this stage.

Series C funding sessions are reserved for companies that have already achieved significant success. These corporations need additional funding to produce new goods, enter new markets, or buy other businesses. Series C capital is aimed at helping the companies scale and expand as rapidly and successfully as feasible.

You can raise money for your business in various methods, but they fall into two basic categories: borrowing money to be returned later or selling shares in your company. However, within each category, you’ll find a range of funding alternatives, and the ideal one for you will depend on factors like:

You have the following choices for borrowing money:

Rather than relying on banks and financial institutions, P2P lending connects smaller investors with small enterprises in need of financing, eliminating the middleman. You can apply online and acquire a loan taken from the savings of those who want to get a higher return on their money. Loan amounts range from $1,000 to $1 million, with an application process as simple as filling out a form. It’s quite easy to pay back a P2P loan because the interest rate is agreed upon in advance. However, if you can’t afford to repay, the regular debt rules apply.

Quick and easy small company loans are available from almost all high street banks, with loan amounts typically ranging between $1,000 and $50,000 and very flexible payback periods. In the same way that obtaining a mortgage can be difficult, acquiring a loan can be even more difficult because you need to prove that you are a sound financial investment and will be able to repay the loan.

A detailed business plan that includes financial projections and a specific plan for how you want to spend the money is an absolute necessity.

If you’re applying for a loan to buy a firm, tell your bank about the assets you’ll be purchasing. Include liabilities as well, to be on the safe side.

Your investor options may include:

Venture capital investments can be an excellent funding source for a new business. Venture capitalists invest in businesses in exchange for a portion of the company’s equity.

Limited partners contribute their money to the venture capital fund, which is managed and used by the investment firm. Each limited partner contributes to the VC fund, which grows in size as the contributions accumulate.

A venture capital firm can be compared to a fund manager who has the power to accept or decline investments.

These companies provide funding to start-ups in exchange for an equity stake in the company. As a start-up, utilizing equity to finance a company is a wise decision since equity keeps investors engaged, significantly impacting the amount of value an investment firm can generate.

VCs are more likely to get involved in Series A funding rounds than seed rounds of fundraising because this stage is substantially less risky. Series A is also often when a start-up needs help transitioning from a new small start-up to one capable of producing a product.

Being involved in a business earlier in its lifecycle means that an investor has the opportunity to have a more significant impact on its growth and success. As a result, you’ll need an exceptional strategy, a bulletproof business plan, and a dynamite pitch—not to mention a bit of luck—to succeed.

As the name implies, angel investors are individuals who have made it in the business world and are interested in investing a portion of their net worth in a new startup venture. They are typically high-net-worth individuals who make investments in businesses in their early stages of development. It’s a great way to raise money in the early stages. Because of their ability to fund early on in the process, angel investors are most commonly used during seed rounds of investment.

For angel investors, early startup investing is a high-risk, high-return game with a high potential for reward. In addition to their money, angel investors may have essential business skills and guidance that can help your company develop. Therefore, angel investors are an excellent way for startups to obtain the first funding they require without going into debt.

Angel investors place a high value on the founding team of a startup. A venture capitalist has to consider the needs of shareholders, employees, and other stakeholders. On the other hand, an angel investor is more willing to take a risk when it comes to investing in the early phases.

In the same way venture capitalists invest in exchange for a stake in the company, angel investors must believe in your firm’s potential and you as an entrepreneur and leader.

Crowdfunding is a method of raising money that relies on a large number of people donating in small increments to meet capital needs.

An early type of crowdsourcing was introduced in 2003 under “ArtistShare.” Musicians were able to receive the cash they needed through this platform in order to record their music digitally.

In today’s world, many crowdfunding platforms use a rewards-based system to motivate donors.

The ideal candidates for this approach are consumer-facing businesses that have a product or a goal that people can get behind. In essence, a firm using a crowdfunding site would produce a promotional video outlining the product they wish to develop. Investors (ideally a large number) take minor stakes in your business after you have sent out a message outlining why it’s a sound financial investment. It’s basically a digitalized version of the traditional stock offering, and some companies have raised more than $4 million from thousands of micro-investors.

Although crowdsourcing may sound like a great approach to getting money, there are some drawbacks. Firstly, these crowdfund services typically take a cut of the funds raised throughout the funding stage. Even though this proportion doesn’t seem like a significant problem, it needs to be considered when setting a financial goal.

The second problem is that, while crowdsourcing can help a startup raise money, it cannot motivate investor interest in the startup’s prospects for success.

Both venture capitalists (VCs) and angel investors (angel investors) work hard to make sure a startup is on the right track and has all it needs to thrive. The driving force behind this helpful attitude is that these investors have a significant stake in the firm to be compelled to assist. More shares mean that investors are less willing to go the extra mile to help the firm out.

At one time, bootstrap funding was the most common method of securing capital for a firm. Bootstrap funding is a term used to describe how a business obtains financial support.

Bootstrapping is a business model where the founder or founders finance the company out of their pocket. This could be done in several ways, including borrowing funds or dipping into their savings.

One of the critical advantages of bootstrapping a business is that a startup can retain complete control of the company without having to delve into its equity. Even though it’s a good option for people who want full control over their startup, bootstrapping is one of the riskiest methods.

In situations where personal finances are at stake, there is tremendous pressure on the startup to succeed. If a startup fails and personal finances were used, the founder is still accountable for any debts incurred, and no money invested can be recouped.

Another disadvantage of bootstrapping is that it usually takes longer than going out and attempting to find investors. While bootstrapping can save a company’s equity, it doesn’t save time, which might have a negative impact on a startup’s success.

Due to rising startup costs, the utilization of bootstrapping methods has decreased significantly. An average seed funding round in today’s business market is roughly $2.2 million. This is not a massive ask for venture capital firms or other investors, but if it’s coming out of the founders’ pockets, this figure is often too costly for a startup to consider using bootstrap tactics.

In searching for a new job, many people learn the art of networking. Due to its association with finding a job, networking is sometimes neglected as a strategy to secure startup funding. However, it is a very valuable tool in raising capital.

Fundraising through networking is all about connecting with people you know who can help you either by contributing funding themselves or connecting you with those who can. It is also a great approach to meeting people who can support your startup in other ways besides money. It’s never a bad idea to have contacts in the business world because you never know who you’ll run across in your network who can help fund or resource your startup.

A network connection can give you access to a venture capital firm or an angel investor’s office in many cases. Having someone in your network speak highly of you can go a long way toward securing an investor meeting.

With so many startups competing for investors’ attention, getting a meeting is becoming increasingly difficult. A founder’s chances of securing an appointment and receiving funding are considerably increased if they have an extensive network of connections.

Of course, if you have the resources, you can fund your business entirely with your own money. In the event that you run a company, one option is to increase your share capital by buying additional shares. This will increase the company’s assets, but it will keep your money locked up until you sell those shares.

You can temporarily inject funds into your business using your director’s loan account. This is referred to as a cash infusion. You can then request that this money be returned to you later when needed.

When looking for financial investment, don’t just focus on cost and convenience. Consider your long-term goals and weigh the risks of each alternative.

Borrowing money or looking for investment is your primary option. If you take out a loan, you keep full ownership of your company, but you’ll be responsible for the repayments, which could limit your company’s growth. Both types of financing have both advantages and disadvantages: You can get a capital injection without having to repay it, but you’ll have to share that growth with your shareholders. Consult with your accountant to determine the best course of action for your specific situation.

Unfortunately, money is involved in financing and investing, and money breeds predatory business practices, scams, and other bad things. So, to stop you from repeating the mistakes, we’ve put up this list of reminders.

Private placement, angels, and friends aren’t necessarily reliable sources of investment capital. Some investors can be trusted in terms of capital, while others cannot. Investment from less well-known sources of capital should be approached with utmost caution.

Don’t spend someone else’s money before doing the required legal work. Make sure the paperwork is done by a professional and that it is signed.

It’s never a good idea to part with cash that wasn’t provided as promised. In many cases, businesses receive financial promises and contract for costs only to have the funding withdrawn.

Friends and relatives may not always be the best source of capital for your business. You risk losing friends, family, and your company all at once.

Bootstrapping is the term used to describe starting a new business using personal savings or home equity. Only Startups with excellent growth potential get financing from the outside world. It is infrequent to come across a venture capital deal. Collateral and guarantees are the only things lenders look at when determining a borrower’s eligibility. Borrowing money is a common practice for established firms but not for startups.

Depending on the nature of your business, there are several possible steps you can take. Typically, high-tech startups should seek out angel investment first, whereas established enterprises should seek a small business banker.

Investment is a big deal, but how do you get ready?

The first step in preparing for a capital raise is to organize your financial data. To get the cash you need, you’ll need everything from an executive summary to a company structure, marketing strategy, financial statements, tax returns, bank statements, and other legal paperwork in order.

How much does it cost to start a business?

All of this depends on how quickly you want to grow your firm and your business model. Your initial money will be used for product development, team members needed to carry out your idea, and technological costs. Costs related to location, research, and marketing must be factored into your budget as your business grows. Before you begin looking for investors, you’ll need to conduct research, write a business plan, and build a prototype of your product.

What exactly is venture capital?

VC finance is a form of private equity, and it’s one of the ways firms with promising growth potential can secure capital. Venture capitalists manage these money pools (VC funds), but they don’t usually invest their own money.

What are the various stages of startup funding?

Every entrepreneur and startup developer should be familiar with the seven primary stages of startup fundraising. However, not every startup will continue to the next step in this linear progression for successful businesses.

Capital is an essential requirement for any organization to succeed. This is because finance is the crucial ingredient for any business to grow. A lack of financial resources can lead to a business startup’s demise, which prompts its founders to seek outside funding for their startup. Using the strategies outlined in this tutorial can significantly boost the chances of your startup’s survival. This guide’s funding sources, such as bootstrapping, etc., are the most effective ways to get started.

It’s also essential that you often modify your funding sources to remain competitive in the market. This gives you some degree of freedom and reduces your reliance on a single source of financing.

Top quality ensured or we work for free