Crypto Ecosystem 2023

The rise in the crypto market is likely due to a combination of factors, including increased adoption and mainstream acceptance of cryptocurrencies and new regulations emerging to make the crypto space more secure.

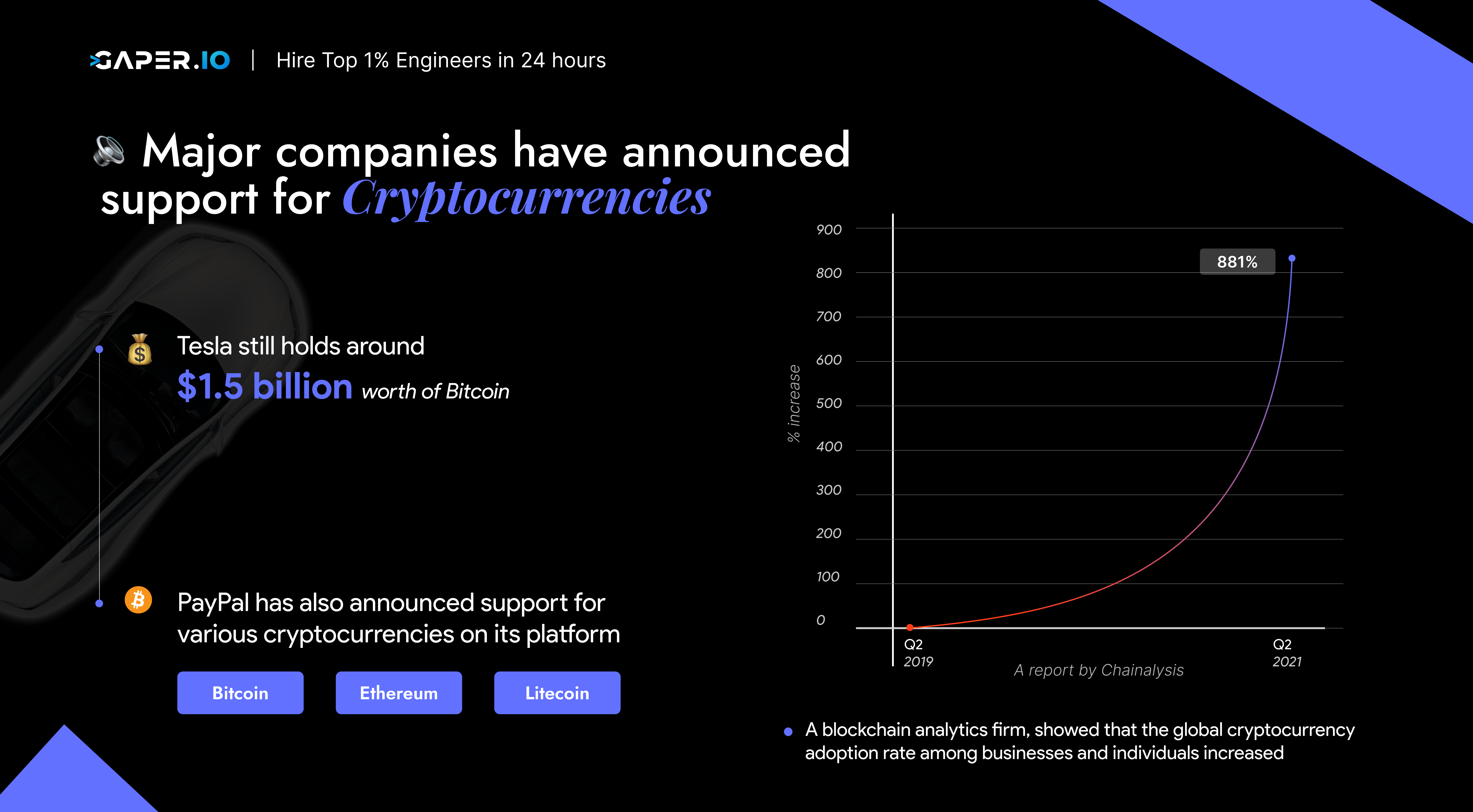

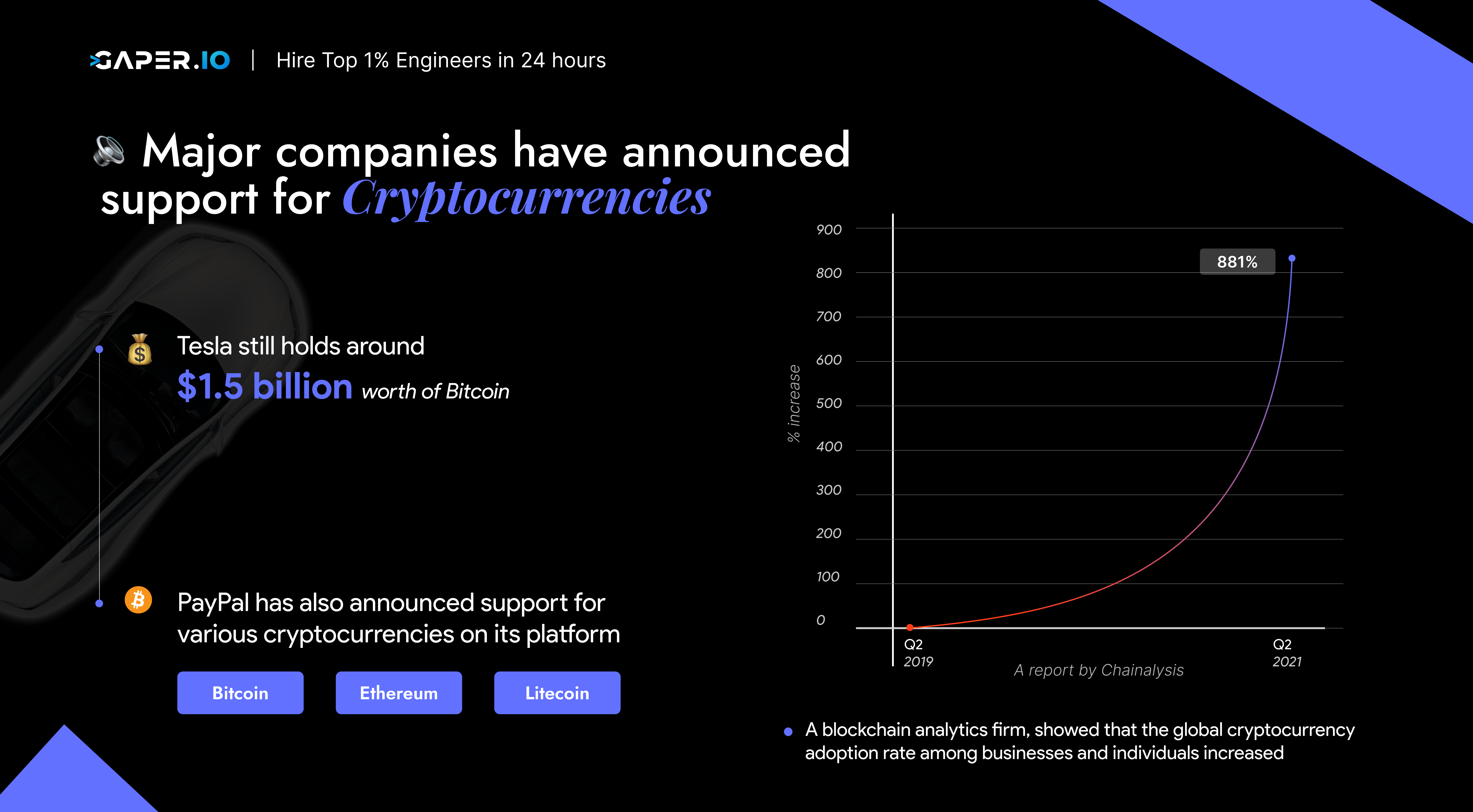

In recent years, we have seen more and more businesses and individuals begin to accept cryptocurrencies as a form of payment. Major companies like Tesla and PayPal have announced support for cryptocurrencies, and many smaller businesses have followed suit. In fact, as of March 2023, Tesla still holds around $1.5 billion worth of Bitcoin. PayPal has also announced support for various cryptocurrencies on its platform, including Bitcoin, Ethereum, and Litecoin. This increased adoption has helped to legitimize cryptocurrencies and improve their overall value.

Furthermore, a report by Chainalysis, a blockchain analytics firm, showed that the global cryptocurrency adoption rate among businesses and individuals increased by 881% from Q2 2019 to Q2 2021.

At the same time, governments and regulatory bodies worldwide have begun to take a more active role in regulating the crypto space. This is likely due to concerns about using cryptocurrencies for illicit activities like money laundering and terrorism financing. However, increased regulation can also help make the crypto space more secure for legitimate users.

For example, some countries have introduced regulations around the use of crypto exchanges, requiring them to implement stronger security measures and know-your-customer (KYC) requirements. This can help to prevent fraudulent activity and protect users’ funds.

Above all, the rise in the crypto market is a complex phenomenon influenced by various factors. Increased adoption, mainstream acceptance, and new regulations are all likely contributing to the growth of the crypto market.

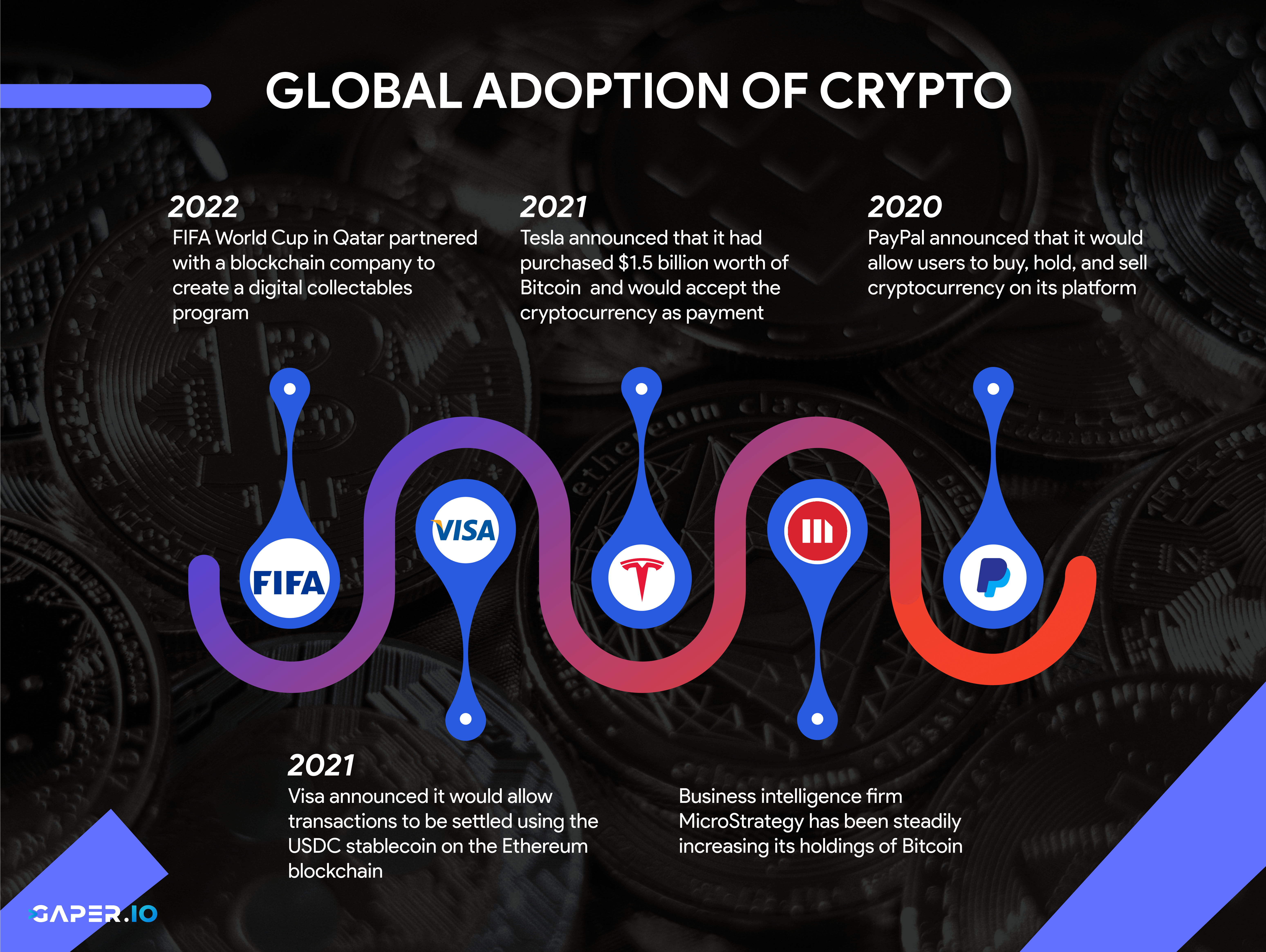

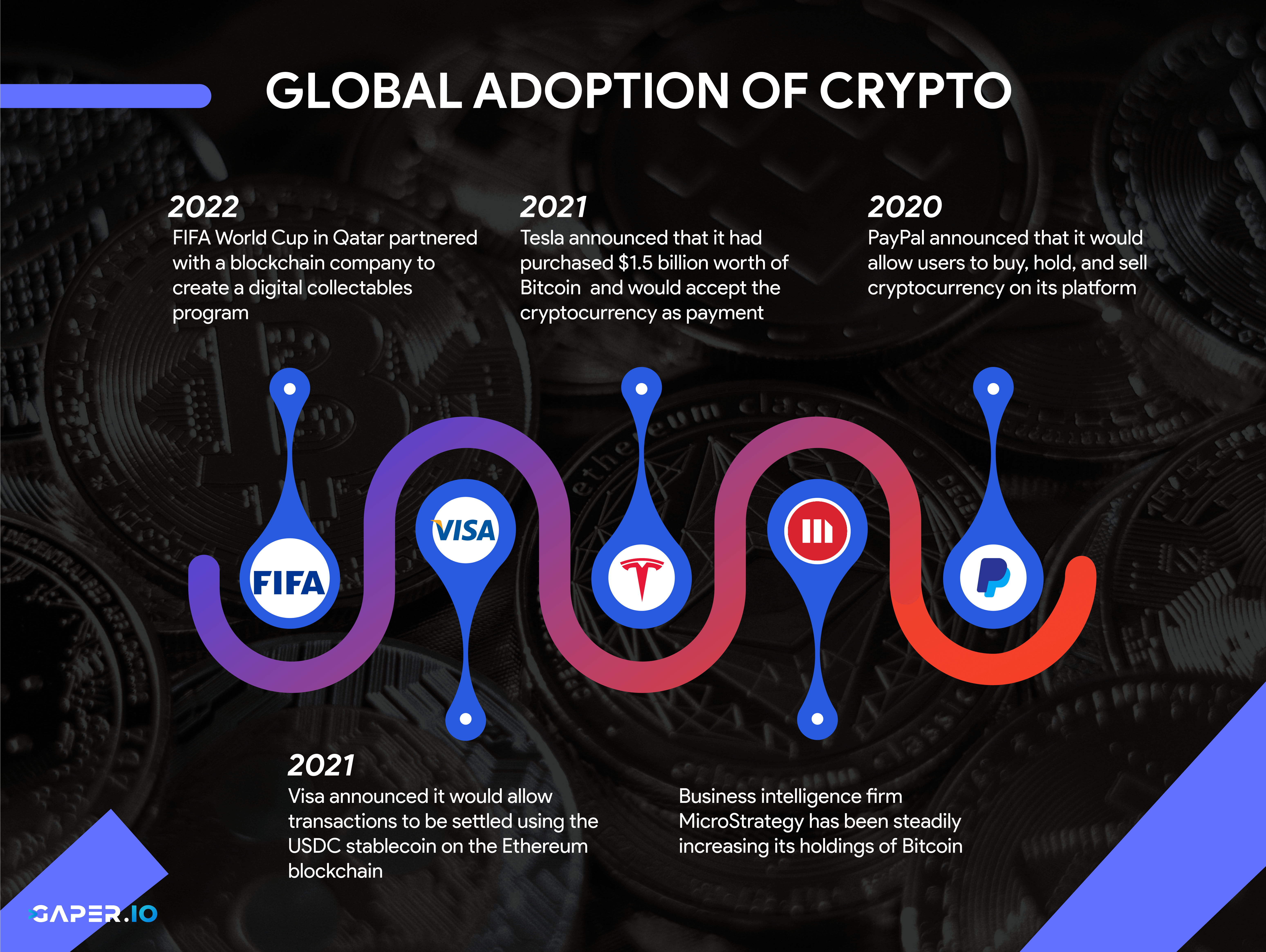

Global Adoption of Crypto

As cryptocurrencies continue to gain momentum, it’s clear that global adoption is on the rise. Let’s take a closer look at some recent examples of how blockchain technology and digital currencies are being embraced by major companies and events around the world.

- FIFA World Cup Qatar 2022: The organizers of the upcoming FIFA World Cup in Qatar partnered with a blockchain company to create a digital collectibles program. Fans could purchase and trade digital collectibles using cryptocurrency, adding a new level of excitement and engagement to the event. The use of blockchain technology in sports can help create more transparent and secure transactions, reduce fraud, and provide a better fan experience. The success of this program at the FIFA World Cup in Qatar 2022 could pave the way for other sports leagues and events to incorporate blockchain technology into their offerings.

- Tesla and Bitcoin: In 2021, electric car maker Tesla announced that it had purchased $1.5 billion worth of Bitcoin and would accept the cryptocurrency as payment for its products. This move helped increase mainstream Bitcoin acceptance and sparked renewed interest in cryptocurrency.

- PayPal and cryptocurrency: In 2020, PayPal announced that it would allow users to buy, hold, and sell cryptocurrency on its platform. This move made it easier for mainstream users to get involved in the crypto space and helped to increase adoption.

- Visa and cryptocurrency: In 2021, Visa announced it would allow transactions to be settled using the USDC stablecoin on the Ethereum blockchain. This move could help to increase the adoption of cryptocurrencies as a form of payment for everyday transactions.

- MicroStrategy and Bitcoin: Business intelligence firm MicroStrategy has been steadily increasing its holdings of Bitcoin, with CEO Michael Saylor advocating for the cryptocurrency as a store of value. This move has helped to increase institutional adoption of Bitcoin and other cryptocurrencies as a long-term investment.

What are the emerging crypto themes to watch out for?

Based on current trends and analysis, here are some potential emerging themes to watch out for in the crypto space in 2023:

- Increased adoption: Increased adoption of cryptocurrencies is expected to continue as more businesses and individuals realize the benefits of using cryptocurrencies as a form of payment. This could lead to the mainstream acceptance of cryptocurrencies as a viable alternative to traditional forms of payment and could drive further innovation in the space.

- Regulatory clarity: Governments and regulatory bodies around the world are taking a closer look at cryptocurrencies and are developing regulatory frameworks to provide more clarity and stability for investors and users. The instant they will guarantee addressing concerns around security, fraud, and money laundering, the greater mainstream adoption of cryptocurrencies will be seen.

- Decentralized Finance (DeFi): DeFi is an emerging trend in the cryptocurrency space, with a focus on creating a decentralized financial system using blockchain technology. It includes applications such as lending, borrowing, and trading, which are all conducted through smart contracts on the blockchain. As more people become interested in DeFi, we can expect to see continued innovation in this area.

- Non-Fungible Tokens (NFTs): NFTs have attracted considerable interest in the art industry, with digital art fetching millions of dollars in sales. Nevertheless, NFTs have the potential to be applied beyond the art industry, such as in gaming, real estate, and other sectors. As more individuals become familiar with the distinctive attributes of NFTs, we can anticipate further growth and progress in this domain.

- Central Bank Digital Currencies (CBDCs): Several central banks worldwide are exploring the idea of issuing their digital currencies, which could provide more efficient payment systems and greater financial inclusion. CBDCs could also provide a level of stability that is not present in cryptocurrencies, which could increase their mainstream adoption.

- Privacy: Privacy-focused cryptocurrencies and blockchain networks have gained popularity as users become more concerned about data privacy and security. As privacy concerns continue to grow, we can expect to see more innovation in this area, including the development of new privacy-focused cryptocurrencies and blockchain networks.

- Scalability: As blockchain technology becomes more widely adopted, there is a need for scalable solutions to enable mass adoption and facilitate large-scale transactions.

- Stablecoins: As volatility remains challenging for cryptocurrencies, stablecoins pegged to fiat currencies could gain more popularity as a stable store of value.

- Interoperability: As the number of blockchains and cryptocurrencies continues to grow, interoperability solutions could become more important to facilitate seamless transfers of value across different networks.

- Environmental concerns: Cryptocurrency mining has come under scrutiny due to the amount of energy it consumes, and there is increased pressure on the industry to become more sustainable and energy-efficient. We can expect to see more focus on green mining practices, as well as the development of new energy-efficient mining technologies.

These are just a few potential themes to watch out for in the crypto space in 2023. The crypto market is highly volatile and unpredictable, so it is essential to stay informed and monitor the latest developments closely.

Opportunities For Raising Capital

The markets for cryptocurrencies and blockchain technology present a number of distinct opportunities for raising capital, but each one has its own risks and advantages. Before choosing a fundraising strategy, startups should carefully weigh their options and seek expert counsel.

- Initial Coin Offerings (ICOs): ICOs allow startups to raise capital by issuing new digital tokens that can be bought and sold on cryptocurrency exchanges. Investors buy these tokens with existing cryptocurrencies like Bitcoin or Ethereum, and in exchange, they receive the new tokens at a discount. ICOs can be a high-risk, high-reward way to raise capital in the crypto space. The largest ICO to date is the EOS.IO project, which raised $4.1 billion in 2018.

- Security Token Offerings (STOs): While ICOs have lost popularity due to regulatory concerns and scams, STOs are gaining traction as a more regulated and compliant way to raise capital in the crypto space. STOs are subject to securities laws and regulations and can offer investors greater legal protection. The largest STO to date is the tZERO security token offering, which raised $134 million in 2018.

- Venture capital and private equity: Traditional venture capital and private equity firms increasingly invest in crypto and blockchain startups. This can provide startups with more stable, long-term funding and the expertise of experienced investors.WhatsApp. Facebook’s $22B acquisition of WhatsApp in 2014 was (and still is) the largest private acquisition of a VC-backed company ever.

- Token sales through decentralized exchanges: Decentralized exchanges (DEXs) allow startups to sell their tokens directly to investors without a centralized intermediary. This can provide startups with greater flexibility and control over the sale of their tokens. Still, it can also be more complex and require a deeper understanding of the underlying technology. The top token sales through decentralized exchanges in 2023 were: Covo– Best DEX for trading cryptocurrencies with upto 50X leverage, Uniswap– DEX with the highest number of trading pairs, Curve Finance– Best Exchange for swapping and trading stablecoins, Pancake Swap– Best DEX on Binance Smart Chain (BSC).

- Initial Exchange Offerings (IEOs): IEOs are similar to ICOs, but the tokens are sold directly on cryptocurrency exchanges rather than through the startup’s own website. This can provide greater visibility and access to potential investors but also require the startup to pay listing fees and meet certain regulatory requirements. Here are ten of the best crypto exchanges to buy cryptocurrency in 2023: Coinbase, Binance, Crypto.com, KuCoin, Gemini, Kraken, CEX.IO, Changelly

*Please note that ICOs are a rapidly evolving area of the cryptocurrency industry, and the statistics provided may be subject to change as new data becomes available.

Challenges For Raising Capital Amidst Latest Crypto Scandals

The recent crypto scandals and regulatory crackdowns have created challenges for raising capital for crypto projects. Some of the challenges include the following:

Regulatory uncertainty and crypto scandals is a major challenges for crypto projects, with different countries and jurisdictions taking different approaches to regulating crypto. This uncertainty makes it difficult for crypto projects to comply with regulations and for investors to know whether their investments are safe. Some of the challenges include the following:

- Investor skepticism: Investor skepticism in the crypto industry is fueled by recent high-profile frauds and scams that have resulted in significant financial losses. These events have created a sense of distrust and wariness among investors, making it difficult for legitimate crypto projects to raise funds. Many investors are wary of investing in an industry that has a high level of risk and uncertainty.

- Regulatory uncertainty: The regulatory environment for crypto is constantly evolving, and there is no clear global regulatory framework for the industry. Different countries and jurisdictions have different approaches to regulating crypto, and this makes it difficult for crypto projects to comply with regulations and for investors to know whether their investments are safe. The lack of regulatory clarity also makes it difficult for institutional investors to get involved in the industry.

- Lack of transparency: Many crypto projects lack transparency, making it difficult for investors to fully understand the risks and potential rewards of investing in a particular project. This lack of transparency can lead to cautiousness or hesitation among investors, particularly in the absence of clear regulation. Investors need to have access to clear and reliable information to make informed decisions.

- Volatility: The crypto market is highly volatile, with rapid and unpredictable fluctuations in value. This volatility makes it difficult for investors to accurately value crypto projects and assess their potential returns. The high volatility also increases the risk of losses, which can make investors hesitant to invest in the industry.

- Limited institutional involvement: Despite growing interest from institutional investors, many remain hesitant to invest in the crypto industry. Institutional investors have concerns about regulation, volatility, and lack of transparency. The lack of clear regulation and established infrastructure can also make it difficult for institutional investors to get involved in the industry.

- Security concerns: Security is a significant concern in the crypto industry, with several high-profile hacks and thefts occurring in recent years. These incidents have led to significant losses for investors and eroded industry confidence. Crypto projects need to prioritize security and take steps to ensure that their systems are secure and resistant to attacks to build investor trust.

- Difficulty accessing traditional funding: Many crypto projects face difficulties accessing traditional funding sources, such as banks and venture capitalists. This is due to the perceived risk and uncertainty associated with the industry, as well as the lack of familiarity with crypto among traditional investors. The difficulty in accessing traditional funding sources can make it more challenging for crypto projects to raise funds and grow their businesses.

- Competition: The crypto industry is becoming increasingly crowded, with new projects launching regularly. This competition can make it challenging for established projects to stand out and attract investment, particularly if they are not well-established or do not have a strong track record. New projects with innovative technology or a unique value proposition can quickly gain investor attention, making it difficult for established projects to keep up.

- To overcome these challenges, crypto projects will need to focus on building trust, transparency, and compliance with regulations. Crypto startups need to be more transparent about their operations and showcase their commitment to regulatory compliance. They will also need to educate investors about the risks and rewards of investing in crypto and work to attract institutional investors.

Final Thoughts:

For the cryptocurrency industry to recover from the challenges and ambiguity of 2022, market participants and authorities will need greater transparency. Along with implementing more transparent worldwide legislation and legal compliance, organizations and regulators play a significant role in narrowing the information gap between users and investors. It will be important for business leaders and companies in the blockchain industry to strive to regain people’s trust.

Recent trends indicate that 2023 will be a boom year of expansion and new developments. Cryptocurrency will only survive as an industry if there is widespread awareness of its benefits and the innovations that underpin it. Hash rates on the Bitcoin network remained stable for the majority of the past year, and with the next Bitcoin halving anticipated to take place in 2024, industry participants have a responsibility to do the bare minimum, which is to work towards better-educating users on the functioning of blockchain and distributed ledger technology. Although 2022 was a challenging year for the cryptocurrency market, 2023 promises many exciting developments and new applications for the sector.

FAQs

- What are the biggest challenges for crypto businesses in raising capital?

The biggest challenges for crypto businesses in raising capital include regulatory uncertainty, lack of institutional involvement, investor skepticism, volatility, and limited access to traditional funding sources.

- How does regulatory uncertainty affect crypto businesses?

Regulatory uncertainty creates challenges for crypto businesses regarding compliance and investor confidence. The lack of clear and consistent regulations makes it difficult for crypto businesses to comply with all applicable laws and regulations, which can increase the risk of legal issues and regulatory fines. Additionally, regulatory uncertainty can erode investor confidence, making it more difficult for crypto businesses to attract investment.

- What are the main challenges that crypto businesses face in acquiring funding amidst scandals?

Crypto businesses’ main challenges in acquiring funding amidst scandals include investor skepticism, reputational damage, regulatory scrutiny, and heightened security concerns.

- How does limited institutional involvement affect crypto businesses?

Limited institutional involvement can make it more difficult for crypto businesses to attract investment and grow their businesses. Institutional investors tend to have larger amounts of capital and can provide more stable funding than individual investors. Additionally, the involvement of reputable institutions can lend credibility to the crypto industry and increase investor confidence.

- How can crypto businesses regain investor trust after a scandal?

Crypto businesses can regain investor trust by prioritizing transparency and accountability, being open and honest about the scandal, and taking concrete steps to prevent similar incidents from happening in the future. They should also prioritize compliance and security and work to rebuild their reputation over time.

- What steps can crypto businesses take to overcome these challenges?

Crypto businesses can take several steps to overcome these challenges, including building credibility, transparency, and trust with investors, prioritizing security and compliance, and attracting institutional investors to the industry. Additionally, they can explore alternative funding sources, such as crowdfunding or initial coin offerings (ICOs), which may be more accessible to early-stage crypto businesses.